BOOK YOUR FREE MEDICARE REVIEW BELOW

Life is complicated. Insurance doesn't have to be.

Plan with Confidence

Medicare can be difficult to understand. Our goal is to empower you to make the best decisions for your needs & budget.

Custom Coverage

You deserve a plan that is tailored to your needs. We will review your plan annually to assess any changes that may be needed.

Dedicated Team

Our phones are always open to take any questions or concerns you might have during your coverage period.

70% ages 65 and older will need long-term care

MEDICARE DOES NOT COVER LONG-TERM CARE

BRIDGE THE GAP BETWEEN YOU AND EXTENDED CARE

PROTECT YOUR

HARD-EARNED ASSETS

Medicare does not cover Long-Term Care

70% Ages 65 and older will need Long-Term Care Services

Traditional and asset-based planning options

Access our cost of care calculator

FREE BOOK DOWNLOAD

3 Easy Steps to the Right Plan

Our team is on your side. We have the expertise to make Medicare enrollment simple, seamless & personalized to fit your needs.

Book Your Initial Review

You’ll meet with a member of our trained staff so they can get to know you and help define your needs.

Create Your Medicare Timeline

Together, we’ll create a specific plan to accomplish your Medicare goals.

Successfully Enroll in Medicare

Enrolling in the best Medicare plan based on your needs and budget, while avoiding costly enrollment penalties and coverage delays.

Book Your Initial Review

Meet with our team of experts so we can assess your specific needs and help build you a tailored plan.

Create Your Medicare Timeline

Together, we’ll create a customized plan that fits your budget and accomplishes your Medicare goals.

Successfully Enroll

Enroll in your best Medicare plan, while avoiding costly enrollment penalties and coverage delays.

SELF ENROLLMENT FOR PART D

We encourage you to self-enroll in your stand-alone Medicare Part D plan. For Medicare Advantage please book your appointment so we can guide your enrollment process.

SECURE DOCUMENT UPLOAD CENTER

SEND YOUR MEDICARE ADVANTAGE TERMINATION LETTER HERE

Enrollment Penalties

Postponing enrollment can leave you at risk for penalties and decline of coverage in the future.

Coverage Delays

Gain peace of mind knowing your healthcare needs are securely addressed. Enroll in Medicare today and avoid unnecessary coverage delays.

Losing Guaranteed-Issue Rights

Protect your guaranteed-issue rights for Medicare by staying informed and taking timely action to avoid potential loss.

Travel Insurance

Let Brian Scott Insurance Help!

If you have any questions about Medicare, please don’t hesitate to reach out to us. Brian Penner has been helping seniors for 18 years with their Medicare enrollment options.

Medicare Supplement (Medigap) plans can pay 80% of medically necessary foreign travel emergency care, after a $250 annual deductible is met, with a lifetime benefit limit of $50,000. This coverage is limited to emergencies that begin during the first 60 days of a trip outside the U.S. Original Medicare and generally do not cover foreign travel.

We recommend a separate travel insurance plan for international travel.

Industry News

Unlocking Savings on Medicare Supplement Plan G and Plan N with Brian Penner's Expertise

Introduction:

Medicare is a vital resource for many seniors, providing access to quality healthcare. However, even with this valuable program, the associated costs can be overwhelming. That's where Medicare Supplement Plans, such as Plan G and Plan N, come into play, offering additional coverage to bridge the gap. But did you know that there are ways to save money on these plans? In this blog post, we'll explore how you can maximize your savings while introducing you to Brian Penner, a seasoned expert who has been helping Medicare beneficiaries do just that since 2005.

Understanding Medicare Supplement Plans:

Medicare Supplement Plans, often referred to as Medigap plans, are designed to cover the expenses that Original Medicare (Part A and Part B) doesn't cover. They offer peace of mind by taking care of copayments, deductibles, and other out-of-pocket costs, allowing you to focus on your health instead of your wallet.

Two popular Medigap plans are Plan G and Plan N:

Medicare Supplement Plan G: Plan G provides comprehensive coverage, paying for almost all out-of-pocket Medicare costs, except for the Part B deductible.

Medicare Supplement Plan N: Plan N offers robust coverage while requiring you to pay some copayments and the Part B deductible.

Now, let's delve into strategies for saving money on these plans.

How to Save on Medicare Supplement Plan G and Plan N:

Shop Around: One of the most effective ways to save money is by comparing multiple insurance providers. Different insurers may offer the same coverage at varying prices.

Enroll During Open Enrollment: When you first become eligible for Medicare, you have a guaranteed issue right to purchase any Medicare Supplement plan without medical underwriting. Taking advantage of this window can save you money.

Choose Wisely: Consider your health needs and budget when selecting a plan. Plan G may have higher premiums but lower out-of-pocket costs, while Plan N typically offers lower premiums with some cost-sharing.

Utilize Broker Expertise: Enlisting the help of a knowledgeable Medicare insurance broker like Brian Penner can be invaluable. Brian has been assisting Medicare beneficiaries for over 15 years, helping them navigate the complex world of Medicare Supplement plans.

Meet Brian Penner:

Brian Penner is a seasoned Medicare insurance broker with a deep passion for assisting seniors in finding the best possible Medicare Supplement plan to fit their unique needs. With a track record dating back to 2005, Brian has been a trusted resource for countless Medicare beneficiaries, offering expert advice, personalized service, and unmatched dedication.

Brian Penner's Commitment to You:

Tailored Guidance: Brian understands that one size does not fit all. He takes the time to assess your healthcare needs and financial situation to recommend the most suitable plan.

Continued Support: His commitment doesn't end once you've chosen a plan. Brian is there for you every step of the way, helping with claims, billing, and any questions that may arise.

Up-to-Date Knowledge: The world of Medicare is constantly evolving. Brian stays informed about the latest changes and updates to ensure you're always on the best plan for your circumstances.

Conclusion:

Saving money on Medicare Supplement Plan G or Plan N is possible with the right strategies and guidance. By exploring your options, enrolling during the right time frame, and working with a knowledgeable expert like Brian Penner, you can secure the coverage you need while keeping your healthcare costs manageable. Don't hesitate to reach out to Brian to start your journey toward Medicare savings today!

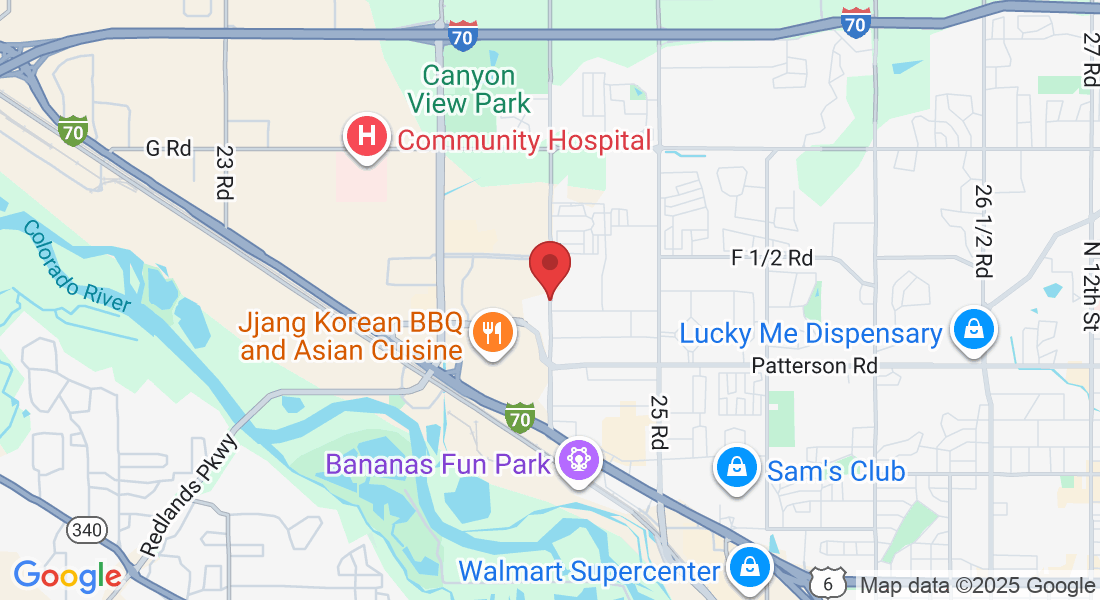

Grand Junction

Located directly across from the Goodwill

Western Colorado Wealth Managment Conultants Office

627 24 1/2 RD Unit H

Graand Junction, CO 81505

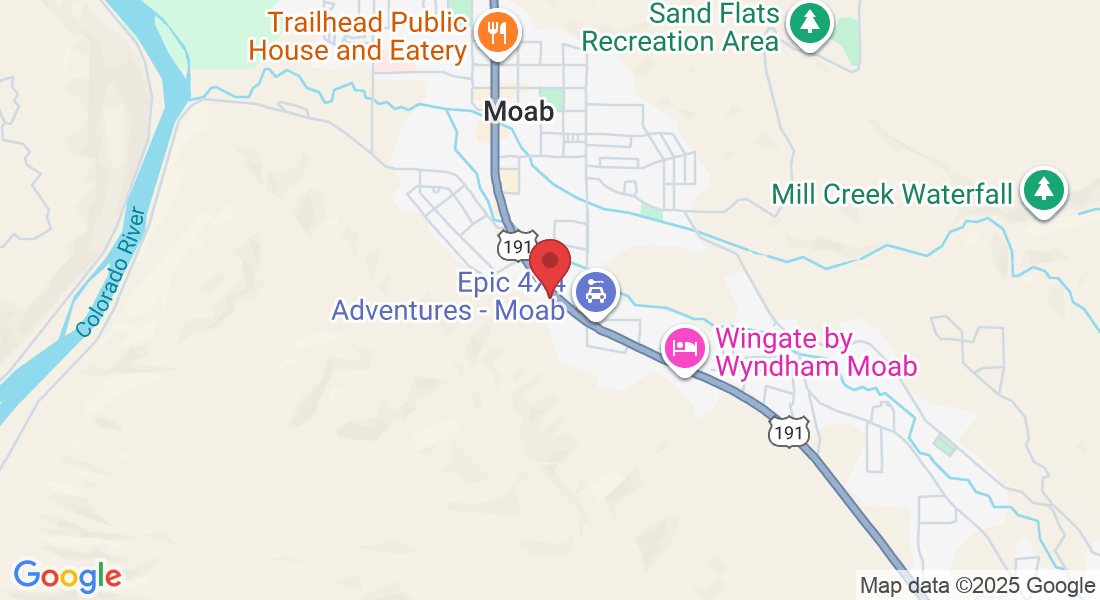

Moab

Located inside Central Utah Insurance Agency

880 S Main St

Moab, UT 84532

Moab, UT

Located Inside:

Central Utah Insurance Agency

880 S Main St

Moab, UT 84532

Grand Junction, CO

Located Inside:

Western Colorado Wealth Management Consultants

627 24 1/2 Road UNIT H

Grand Junction, CO 81505

Copyright 2024 © All Rights Reserved Brian Scott Insurance A Subsidiary Of Kenztara INC

A NON GOVERMENT HEALTH INSURANCE AGENCY

Medicare Required Disclaimer:

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE or your local SHIP office to get information on all of your options.