What are Medicare Supplements?

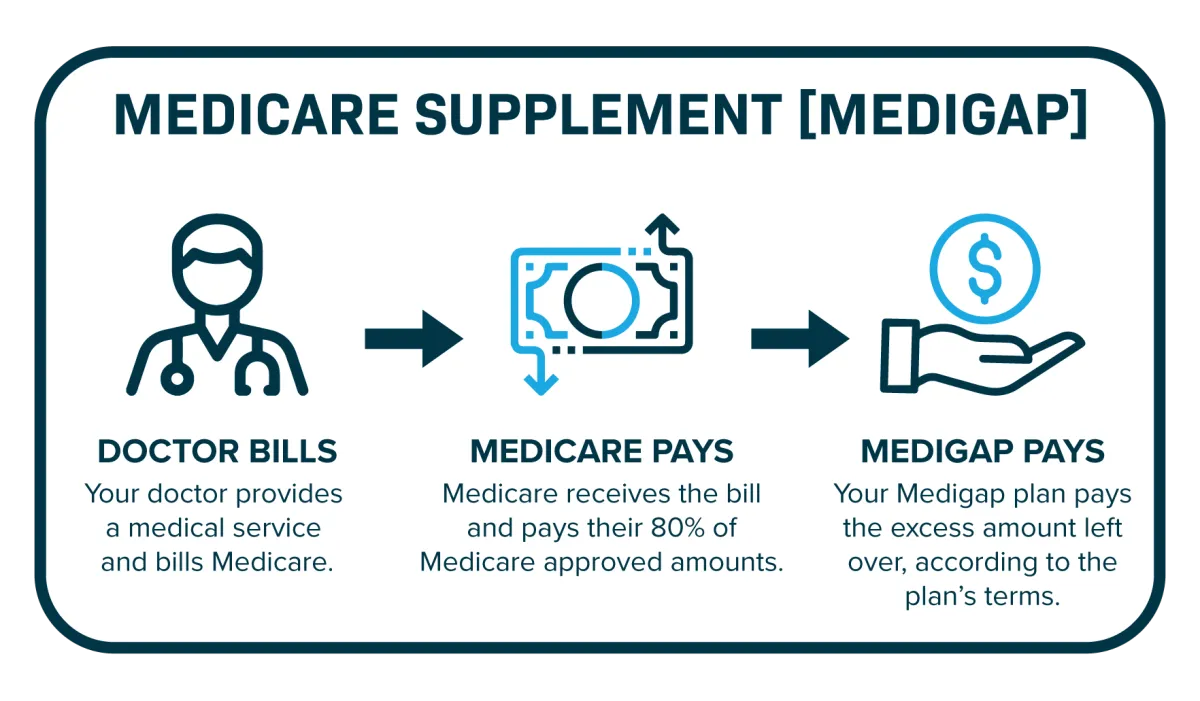

Medicare Supplement plans, also known as Medigap, are policies that help pay for the excess charges left over by Medicare. These costs are things like your deductibles and coinsurance.

What is Medicare Supplement Insurance?

Medicare Supplement plans, or Medigap, are insurance policies sold by private insurance companies that are licensed to sell Medicare plans. They help you pay for out-of-pocket costs for services covered under Medicare Part A and Part B. These costs include deductibles, coinsurance, copayments, hospital costs after Medicare pays its share, skilled nursing facility costs, and more. Some Medicare Supplement insurance plans even include coverage for medical services while traveling outside the United States.

What are the Different Plans?

Different Medicare Supplement plans are labeled with a different letter between A through N.

Medicare Supplements feature different benefits. However, each plan must have the same standardized coverage no matter which insurance company you purchase the plan from.

Some Medicare beneficiaries want a plan that covers everything so they don’t have to worry about out-of-pocket expenses. Others simply want some of their deductibles and copays paid for but are mostly worried about low premiums. Ultimately, the choice is up to you.

Which Medicare Supplements Have the Highest Coverage?

Medicare Supplemental Plan F has the highest level of coverage. It pays for all of your cost-sharing on covered services so you have no out-of-pocket expenses.

Medicare Supplemental Plan G is the second-best in terms of coverage. The only thing not covered is that you still pay the Part B deductible once per year. This keeps your Medigap premium lower and, in turn, may save some beneficiaries some money in the long run.

Five Things to Know About Medicare Supplement Plans

- You must have Medicare Part A and Part B.

- A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

- You pay the private insurance company a monthly premium for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare.

- A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

- It's illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you're switching back to Original Medicare.

SECURE DOCUMENT UPLOAD CENTER

SEND YOUR MEDICARE ADVANTAGE TERMINATION LETTER HERE

Moab, UT

Located Inside:

Central Utah Insurance Agency

880 S Main St

Moab, UT 84532

Grand Junction, CO

Located Inside:

Western Colorado Wealth Management Consultants

627 24 1/2 Road UNIT H

Grand Junction, CO 81505

Copyright 2024 © All Rights Reserved Brian Scott Insurance A Subsidiary Of Kenztara INC

A NON GOVERMENT HEALTH INSURANCE AGENCY

Medicare Required Disclaimer:

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE or your local SHIP office to get information on all of your options.